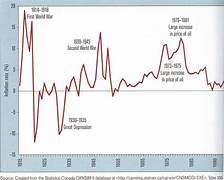

Canada annual inflation rate increased to 3.3% in July, up from 2.8% in June. The increase in inflation is the highest inflation rate since May 2022. The increase was mainly due to a base-year effect in gasoline prices, as a vast monthly decrease in July 2022 was no longer

affecting the 12-month movement.

The average of two of the Bank of Canada’s core measures of underlying inflation, CPI- median and CPI-trim, came in at 3.65%, compared with 3.70% in June.

The Drivers of Inflation The main drivers of inflation in July were food, shelter, and transportation costs. Food prices rose 8.5% year-over-year, shelter prices rose 5.5% year-over-year, and transportation prices rose 4.9% year-over-year.

Food prices are driven by increasing prices for fresh fruits and vegetables, meat, and dairy products. Shelter prices are driven by increasing rent and mortgage interest costs. Transportation prices are driven by increasing gasoline prices and airfares. Here are some additional details from the inflation report:

Gasoline prices increased by 38.9% in July from a year ago. The increase was a year-over- year increase since January 1982.

Food prices increased by 8.5% in July from a year ago.

The increase was the highest year- over-year increase

The increase was the highest year- over-year increase since February 2023. Shelter prices increased by 5.5% in July from a year ago. The increase was the highest year- over-year increase since January 2023. Transportation prices increased by 6.7% in July from a year ago. The increase was thebhighest year-over-year increase since February 2023.

The inflation report was a reminder that the economy is still facing significant inflationary pressures. The Bank of Canada will need to continue to increase interest rates to bring inflation back to its target of 2%. In addition to the factors mentioned above, there are a few other factors that could contribute to inflation in Canada in the coming months. These include: The increase in energy price rise is of the ongoing war in Ukraine. The global supply chain disruptions, which made it more challenging and expensive to get goods to market.

The Bank of Canada’s Response

Canada’s Inflation Rate rises to 3.3% in July:- Canada

Canada’s annual inflation rate increased to 3.3% in July, up from 2.8% in June. The increase in inflation is the highest inflation rate since May 2022. The increase was mainly due to a base-year effect in gasoline prices, as a vast monthly decrease in July 2022 was no longer

affecting the 12-month movement. The average of two of the Bank of Canada’s core measures of underlying inflation, CPI- median and CPI-trim, came in at 3.65%, compared with 3.70% in June.

The Drivers of Inflation

The main drivers of inflation in July were food, shelter, and transportation costs. Food prices rose 8.5% year-over-year, shelter prices rose 5.5% year-over-year, and transportation prices rose 4.9% year-over-year.

Food prices are driven by increasing prices for fresh fruits and vegetables, meat, and dairy products. Shelter prices are driven by increasing rent and mortgage interest costs. Transportation prices are driven by increasing gasoline prices and airfares.

Here are some additional details from the inflation report:

Gasoline prices increased by 38.9% in July from a year ago. The increase was a year-over- year increase since January 1982.

Food prices increased by 8.5% in July from a year ago. The increase was the highest year- over-year increase since February 2023. Shelter prices increased by 5.5% in July from a year ago. The increase was the highest year- over-year increase since January 2023. Transportation prices increased by 6.7% in July from a year ago. The increase was the highest year-over-year increase since February 2023.

The inflation report was a reminder that the economy is still facing significant inflationary pressures. The Bank of Canada will need to continue to increase interest rates to bring inflation back to its target of 2%. In addition to the factors mentioned above, there are a few other factors that could contribute to inflation in Canada in the coming months. These include: The increase in energy price rise is of the ongoing war in Ukraine. The global supply chain disruptions, which made it more challenging and expensive to get goods to market.

The Bank of Canada’s Response

The Bank of Canada will need to monitor these factors in the coming months and make changes to its monetary policy as needed. The Bank of Canada has been raising interest rates to cool inflation. The central bank has increased its policy rate by 50 basis points in its last two meetings. Again, an increase in

interest rates is expected by September.

The Bank of Canada is expected to raise interest rates again in September. Economists are now predicting that the central bank may pause its rate hiking cycle in the fourth quarter of 2023.

The Bank of Canada is facing a challenge balancing act. There is a need to increase interest rates to cool inflation, and also there is a need to avoid increasing interest rates, which would cause a recession.

The Outlook for Inflation:- Canada

The Bank of Canada expects inflation to remain elevated in the coming months, but to start to decline in 2024. However, there is a lot of uncertainty about the future of inflation, which remains higher for longer than the Bank of Canada expects. The Bank of Canada is expected to raise interest rates again in September. However, some economists are now predicting that the central bank may pause its rate hiking cycle in the fourth quarter of 2023. The Bank of Canada is facing a difficult balancing act. It needs to raise interest rates enough to cool inflation, but it also needs to avoid raising rates too much and causing a recession.